| Key Takeaways: Health insurance software is utilized as a strategic tool today that can drive automation, compliance, and customer experience. Custom solutions are better if your requirements dictate scalability, compliance, and product differentiation. Compliance and security are an integrated part of compliance, like HIPAA, GDPR, and other regional data laws. Development costs can vary widely, but cloud-native solutions ensure you get high scalability for growing users and claims. The future of insurance is AI-driven, highly personalized, and connected to all the other healthcare ecosystems. |

The healthcare insurance market was already at 2.94 trillion in the year 2025, and by 2030, it is expected to touch 4.41 trillion. For any startup or business expanding into the insurance domain, it feels like a natural move. So much so that even if you make up a small portion of it, we are talking billions of dollars.

But, as the insurance market is becoming much more integrated in terms of service delivery, not only do you need a credible development partner, but an easy-to-understand health insurance software development guide.

Why? The market is truly competitive, so you need a resource that can introduce you to the fundamental concepts of developing health insurance software. A resource that covers basic aspects like definition and software types, to the cost of development and compliance requirements.

Gladly, being in the development business for over 25+ years, we have helped multiple clients. Through that, we have been able to get our hands on knowledge that’ll truly help you kickstart your next insurance venture. So, let’s begin.

What is Health Insurance Software? – Explained Through Real World Examples!

A health insurance software is nothing but a suite of digital applications. This suite is designed to manage your operations end-to-end, and includes capabilities like:

- Policy administration

- Premium management

- Claims processing

- Compliance

- Customer engagement

At its core, insurance software is nothing more than a modern way to handle health insurance policies and claims management today. But it’s important to know that the combination of these systems can help you achieve tonnes. A few examples include automating complex workflows, reducing human errors, ensuring regulatory compliance, and delivering faster services with transparency to policyholders.

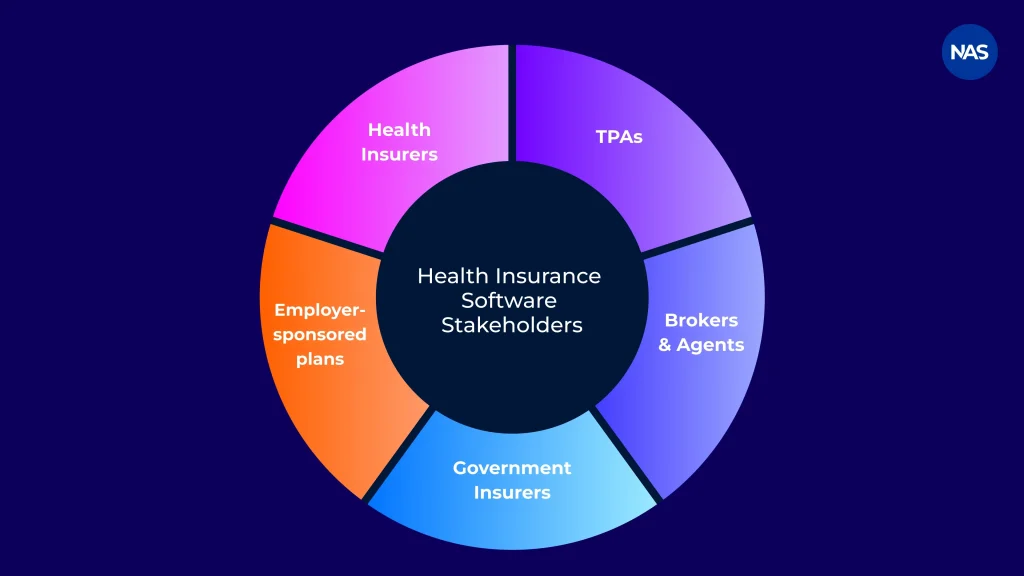

Who Needs Health Insurance Software?

Health insurance software directly impacts multiple stakeholders who are a part of the ecosystem. These are:

- Health Insurers: It helps them manage tasks like policy creation, underwriting, premium collection, renewal, etc.

- Third-Party Administrators: TPAs can manage claims processing, hospital coordination, settlement workflows, etc., using these software systems.

- Insurance Brokers & Agents: This helps them quote plans to customers, onboard them, manage their renewals, track commissions, and a lot more.

- Government-Backed Insurers: The government administers multiple public health schemes, beneficiary databases, high-volume claims, etc. Health insurance software helps the insurers working for the government with these tasks.

- Employer-Sponsored Health Plans: These are programs that you’ll be administering if you’re an employer. It includes management of group policies, employee enrollment, policy customizations, claims tracking, etc.

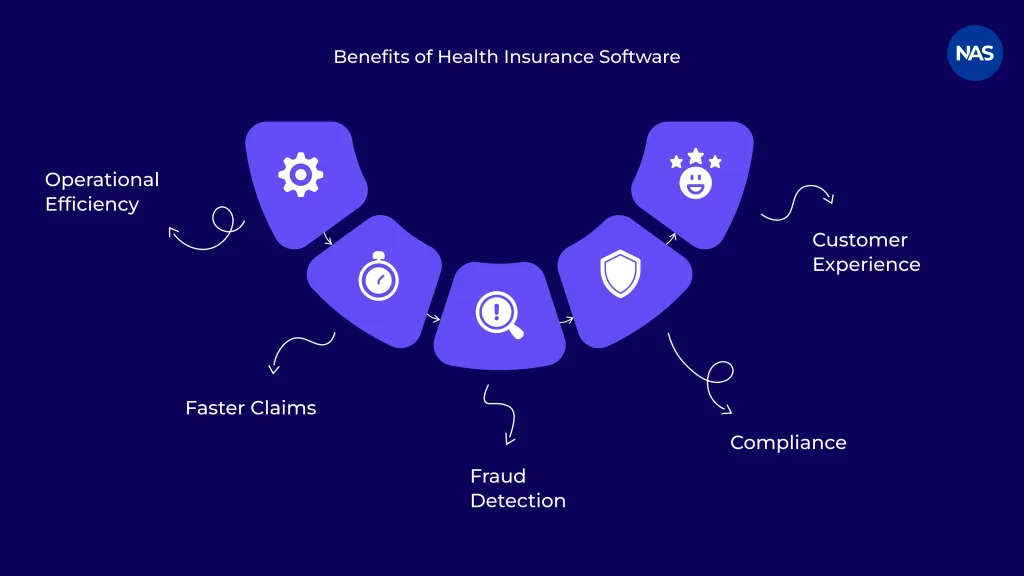

Benefits of Health Insurance Software

Before availing any software development services, it is essential to understand a few direct benefits one can get by investing in insurance software. These software sure helps insurers, TPAs, and healthcare enterprises, but how is the real question.

Well, we have tried to answer it below with as much relevant information as possible:

- Operational Efficiency & Automation: Custom health insurance software solution helps sort out your core workflows. This includes policy issuance, premium calculation, renewals, claims validation, and reporting.

- Faster Claims Settlement: How does it happen? Modern systems accelerate claims processing by automating eligibility checks, rule-based adjudication, and real-time integration with hospitals and policy networks. To add, this leads to reduced turnaround time, minimizes disputes, and improves trust amongst policyholders.

- Fraud Detection & Risk Mitigation: Advanced systems are fed tonnes of historical data; after that, these systems make use of data analytics and AI-driven models. This combination is capable of detecting any duplicate claims, abnormal billing patterns, and policy misuse.

- Regulatory Compliance at Scale: HIPAA and GDPR compliant health insurance software is essential today to operate in the healthcare domain. These software are built with compliance at its core. This enables organizations to stay compliant as per them, including other regional health data laws.

- Better Customer Experience: The best way to engage customers is to enable them to buy policies, track claims, upload documents, and get real-time updates on their own. These systems come equipped with self-service portals and mobile apps that complement the need, doing the aforementioned.

- Data-Driven Underwriting & Pricing: Centralization of data collection and analytics is a proven way to factor in risk more accurately, personalize coverage, and optimize the premium pricing. With these software, you get historical claims, demographic information, and usage patterns to smartly assess your underwriting decisions.

For more clarity, we have compared manual, legacy, and modern health insurance software below. Have a look.

Manual vs Legacy vs Modern Health Insurance Software

| Aspect | Manual Processes | Legacy Systems | Modern Health Insurance Software |

|---|---|---|---|

| Operational Efficiency | Low | Moderate | High (Automated workflows) |

| Claims Processing Speed | Slow | Medium | Fast (Rule-based & AI-driven) |

| Scalability | Limited | Restricted | Highly scalable |

| Compliance Management | Error-prone | Partial | Built-in & auditable |

| Customer Experience | Poor | Basic | Digital-first & self-service |

| Data & Analytics | Minimal | Fragmented | Centralized & actionable |

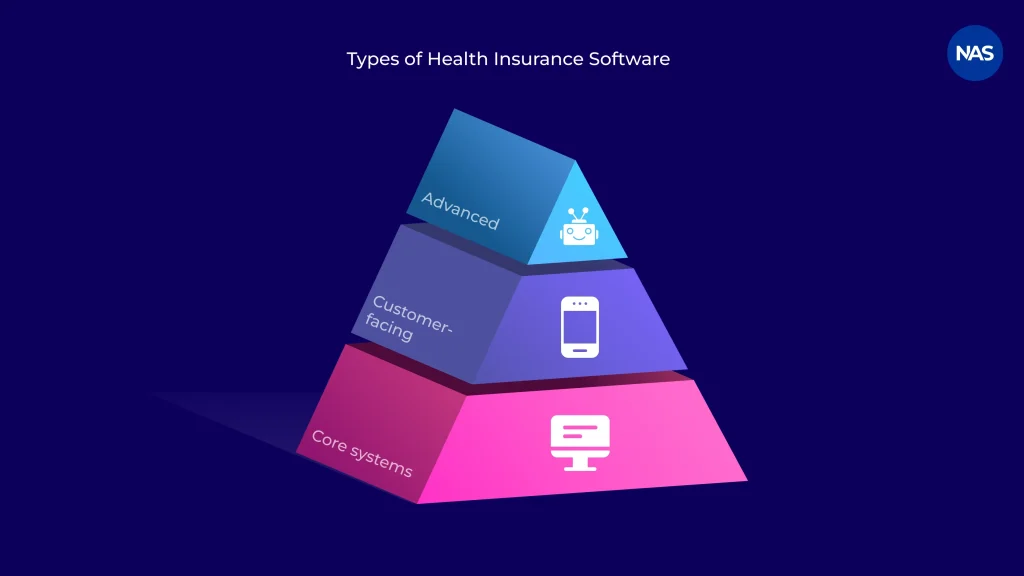

Types of Health Insurance Software Solutions to Invest In!

Health insurance software development sure feels like the next big venture to work on. But what to develop? If you struggle with this question, here are a few options you can set your mind to.

Core Health Insurance Systems

- Policy Administration System (PAS): These are systems that manage tasks like policy creation, enrollment, endorsements, renewals, premium billing, etc.

- Health Insurance Claims Management Software: A software of this category automates claim submission, verification, adjudication, approval, reimbursement workflows, etc.

- Underwriting & Risk Assessment Tools: They specifically cater to tasks like analyzing medical history, demographics, and historical data to assess risk and determine coverage eligibility + pricing.

- Provider Network Management Software: They help hospitals and provider directories with contract terms, tariffs, and cashless treatment eligibility.

Customer-Facing Health Insurance Systems

- Member Portals & Mobile Apps: Ever thought how buying plans, accessing policy details, submitting claims, uploading documents, and tracking claim status have become so easy, well, because of these software/applications.

- Broker Dashboards: This software type helps brokers with client portfolio management, generating quotes, tracking commissions, and handling renewals efficiently.

- Employer Group Portals: It allows organizations to manage group policies, employee enrollments, coverage customization, and reporting.

Advanced & Emerging Health Insurance Solutions

- AI-Powered Claims Automation: These software makes use of machine learning (an AI technique) to automate claims triage, eligibility checks, and decision making, reducing manual intervention.

- Fraud Detection Engines: The systems screen through the data fed to it, detecting suspicious claims, abnormal patterns, and policy misuse.

- Telehealth Integrations: It connects insurance platforms with virtual consultation, remote diagnosis, and digital healthcare providers.

- Data Analytics & Reporting Platforms: They provide real-time dashboards and insights that help in decisions related to underwriting, claims performance, regulatory reporting, and other business decisions.

Health Insurance Software Development Services – Readily Available in the Market

Figuring out the right firm for health insurance software development is one thing, but understanding to what degree they can help is another. This is the reason we have covered a range of healthcare software development services for insurance in this section below.

Let’s go through them one by one:

Types of Health Insurance Software Development Services

- Custom Software Development: Here, you get end-to-end support for health insurance software development. The software built is tailored to your requirements, which includes specific business models, workflows, and compliance requirements.

- Legacy System Modernization: This service allows you to upgrade or re-engineer your outdated insurance systems for improvements like performance, security, scalability, and integration with modern tech.

- SaaS Platform Development: SaaS development services focus on building multi-tenant, subscription-based health insurance platforms. Here, the deployment and lower operational overhead are much faster.

- Cloud Migration & DevOps: It helps migrate insurance systems to AWS cloud-based services or other cloud platforms along with DevOps practices for better reliability, scalability, and continuous delivery.

- API & Interoperability Development: This encapsulates the development of secure APIs and integrations to enable seamless data exchange with hospitals, TPAs, EHRs, payment gateways, and third-party services.

- Compliance Consulting: With this, you get advisory and implementation support on how you can ensure your health insurance systems meet regulatory requirements for HIPAA, GDPR, and other regional data laws.

Custom Health Insurance Software vs Off-the-Shelf Solutions

Choosing between a custom health insurance software solution and an off-the-shelf product totally depends on your organizational requirements. Both have their own merits and demerits. So, to better understand it, we have provided a table below for you to weigh yourself.

Criteria | Custom Health Insurance Software | Off-the-Shelf Solutions |

|---|---|---|

| Compliance Flexibility | High (tailored to regional regulations) | Limited |

| Scalability | High (grows with business needs) | Medium |

| Long-Term Cost | Lower (no recurring license lock-in) | Higher (ongoing licensing & customization costs) |

| Integration Capabilities | Seamless (built for existing systems) | Restricted |

| Customization | Fully customizable | Limited to predefined features |

| Data Ownership | Complete ownership | Often restricted or shared |

When Should Enterprises Choose Custom Health Insurance Software?

Custom development is ideal in situations where:

- The organization operates in multiple regions and has complex compliance requirements

- Existing systems need deep integration with claims, provider networks, or EHR platforms

- Scalability, performance, and data ownership are long-term priorities

- Differentiated customer experience is a competitive advantage

When Does an Off-the-Shelf or SaaS Solution Make Sense?

Off-the-shelf or SaaS platforms are ideal when:

- The business is a startup or new insurer that requires standardized workflows

- Time-to-market is critical to success, or the requirements are minimal

- Budget constraints favor subscription-based pricing

- The solution is only used for non-core or short-term operational needs

In short, if your preference is speed and simplicity, go for off-the-shelf. But if your requirements dictate compliance control, scalability, and strategic value, choose custom health insurance software development.

Compliance & Security in Health Insurance Software Development

Compliance and data security are a foundational requirement for any health insurance software development effort. The significance is high because most of these systems handle sensitive patient data and medical records across jurisdictions.

So, any modern system you design today needs to be under the umbrella of HIPAA or GDPR compliant health insurance solutions, or any other regional compliance, while maintaining security that is enterprise-grade.

Regional Compliance Requirements:

- HIPAA & HITECH (for US): It demands strict safeguards that protect PHI (Protected Health Information). To achieve this, a few integrations like access controls, auditability, and breach reporting are mandatory for both US insurers and healthcare partners, making HIPAA-compliant health insurance software development necessary.

- GDPR (for EU): This law mandates lawful data processing with user consent, data minimization, and the right to erasure of data.

- NHS DSP Toolkit (for GB): The toolkit primarily dictates aspects like data protection, cybersecurity, and governance standards for every software that interacts with NHS systems in the UK.

- UAE Health Data Laws: It enforces health data residency, controlled data access, and cybersecurity compliance for insurance platforms that are operating in the UAE.

Security Best Practices in Health Insurance Software:

- Data Encryption: Use of strong encryption for any data recorded that is at rest and in transit

- Role-Based Access Control (RBAC): Ensuring that only personnel with authorization are given access

- Audit Logs & Monitoring: Demanding features like traceability, compliance audits, and incident detection from the software partner

- Secure APIs: Protecting any data exchange that occurs between insurers, providers, TPAs, and third-party systems.

The best way to develop a HIPAA-compliant app or software that adheres to a regional regulation is by asserting the need to build compliance and security from day one.

How to Develop a Health Insurance Software? – Step-by-Step Process

As a health insurance software development company, we have worked on plenty of health insurance software development projects. The steps mentioned below loosely interpret the pathway we take to develop insurance software for our clients.

Step 1: Requirement Analysis & Stakeholder Mapping

At step one, we aggregate requirements from our clients. For example, business goals, target users, workflows, integration needs, and compliance obligations. This translates into functional and technical requirements that teams turn into reality.

Step 2: Compliance & Risk Assessment

After that, based on the region, we figure out all the relevant regulations to work with. Additionally, we understand the nature of the data and its security risks + compliance controls. Combining this data, we provide all the requirements to our development team so that the product is developed from a regulatory mindset.

Step 3: UX/UI Design for Insurers & Members

This step is about designing dashboards and a self-service interface. Our aim here is to keep it as intuitive as possible. This further simplifies tasks like policy management, claims tracking, and customer interactions across web and possible mobile platforms for the customer.

Step 4: Architecture & Tech Stack Selection

Here, we make the decision of choosing the architecture of the product based on the type of scalability. Also, the tech stack is decided at this step, which helps integrate maximum security, interoperability, performance, and future expansion.

Step 5: Development & Integration

At this stage, we take up core modules and third-party integrations. Common examples in insurance software can be policy administration, claims processing, provider management, EHR integration, payment gateway integration, etc.

Step 6: QA, Security Testing & Compliance Validation

Once the above-mentioned are performed, it is time to test the build. To assess the product in a well-rounded sense, we perform functional testing, performance testing, security audits, and compliance checks.

Step 7: Deployment & Post-Launch Support

The final stage is primarily about deploying the solution in a secure cloud or on an on-prem environment. This is then followed by continuous monitoring, updates, compliance audits, and feature enhancements.

Technology Stack for Health Insurance Software Development

Here is a technology stack commonly used for developing a health insurance policy management system or any software mentioned in the types above:

| Layer | Technologies | Why It’s Used in Health Insurance Software |

|---|---|---|

| Frontend | React, Angular | It enables responsiveness, security, and delivers scalable user interfaces for insurer dashboards, broker portals, and member-facing apps within an enterprise-grade app development service. |

| Backend | Node.js, Java, .NET | Supports high-performance business logic, secure APIs, and complex workflows |

| Databases | PostgreSQL, MongoDB | Combine relational accuracy for policy and financial data with flexible storage for documents, medical records, and claim attachments. |

| Cloud Infrastructure | AWS, Azure | Provide elastic scalability, high availability, disaster recovery, and compliance-ready environments through AWS cloud-based services or equivalent platforms. |

| Interoperability Standards | FHIR, HL7 | Enable secure data exchange between insurers, hospitals, EHR systems, TPAs, and third-party healthcare platforms. |

| AI / ML Capabilities | Python, TensorFlow, ML frameworks | Power automated claims processing, fraud detection, risk scoring, and predictive analytics for faster and more accurate decision-making. |

Cost of Health Insurance Software Development: Realistic Breakdown

The cost of development radically changes with the scope of development, features demanded, nationality of the outsourcing company, and other factors. To pin it properly, we have created tables for a quick glance.

MVP vs Enterprise-Scale Health Insurance Software

| Scope | Typical Features Included | Estimated Cost (USD) | Timeline |

|---|---|---|---|

| MVP | Basic policy management, claims submission, user roles, reports, and security controls | $40,000 – $80,000 | 3–5 months |

| Mid-Scale System | Claims automation, provider network, integrations, dashboards, compliance readiness | $80,000 – $150,000 | 5–8 months |

| Enterprise-Scale Platform | End-to-end policy & claims, AI fraud detection, analytics, multi-region compliance | $150,000 – $300,000+ | 8–14 months |

Cost Breakdown by Core Modules

| Module | Description | Cost Range (USD) |

|---|---|---|

| Policy Administration | Policy creation, enrollment, billing, renewals | $20,000 – $50,000 |

| Claims Management | Submission, adjudication, settlement workflows | $25,000 – $60,000 |

| Provider Network Management | Hospital contracts, tariffs, cashless workflows | $15,000 – $35,000 |

| Customer Portals & Mobile Apps | Member, broker, and employer dashboards | $15,000 – $40,000 |

| Compliance & Security | HIPAA/GDPR controls, audit logs, and access management | $10,000 – $30,000 |

| AI & Analytics (Optional) | Fraud detection, risk scoring, predictive insights | $20,000 – $60,000 |

Factors That Influence Development Cost:

| Cost Factor | Impact on Budget |

|---|---|

| Compliance Requirements | Multi-region regulations (HIPAA, GDPR, NHS, UAE) significantly increase development and testing effort |

| Third-Party Integrations | EHRs, TPAs, payment gateways, and analytics platforms add integration complexity |

| AI & Automation Features | Machine learning models for fraud and claims increase both build and maintenance costs |

| Cloud Infrastructure | High availability, security, and scaling requirements affect ongoing cloud expenses. |

Cost Comparison by Outsourcing Country:

| Country / Region | Average Hourly Rate | Best For |

|---|---|---|

| USA / Canada | $100 – $150 | Complex enterprise systems, strict regulatory compliance |

| UK / Western Europe | $80 – $120 | GDPR-centric solutions, insurance domain expertise |

| Eastern Europe | $40 – $70 | Cost-efficient, high technical quality |

| India | $25 – $50 | Scalable development, strong healthcare & insurance expertise |

| Southeast Asia | $20 – $40 | MVPs and budget-constrained projects |

Where NewAgeSys Comes Into the Picture?

If you’re looking to hire health insurance software developers, we have been in the business for more than 25+ years, as mentioned earlier. We have worked with clients across industries, including healthcare and insurance.

For better clarity, you can check out our case study about our client, “USA Health Advisory”, or read in brief below, how we helped them:

- Developed a custom insurance app for agent-led policy submissions

- Digitized their forms with e-signatures and cloud storage

- Enabled capabilities like multi-device access and admin tracking

- Reduced paperwork for them while simultaneously improving agent efficiency

And, the things mentioned above are not the entire picture. Additionally, partnering with us gives further benefits both in terms of reliability and service capabilities.

- We deliver end-to-end development services (from design to deployment)

- We have strong healthcare & HIPAA compliance expertise

- We can build a custom solution as per your requirements

- We offer capabilities like AI, automation, and analytics

- Our approach is security-first and compliance-driven

- We make use of Agile and believe in process transparency

- We also have expertise in web & mobile build

- We offer engagement models like a dedicated team, staff augmentation, project-based models, etc.

So, if you’re interested in working with us, use the CTA below to reach out to us.

Future Trends in Health Insurance Software Development

The health insurance software development domain has been rapidly evolving. And, today it’s driven by AI, data analytics, and other emerging technologies that are improving its efficiency and effectiveness.

So, without any further waiting, let’s uncover the most persistent trends that one can witness this year so that you can double down on them based on your future needs.

- AI-driven claims adjudication: AI is dominating the industry for processes that involve verification, processing, and decision-making for claims. It is enabling real-time adjudication, faster approval (often in minutes), and reduced errors. In fact, the projection states that over 35% of insurers are deploying AI across core functions to cut processing times by up to 70%.

- Embedded insurance: Coverage integration today is encapsulating digital health platforms, apps, and non-insurance ecosystems like telehealth or wellness apps. This, thereby, is offering contextual and on-demand products.

- Blockchain for claims transparency: Blockchain offers advantages like decentralization and tamper-proof records. This is for the same reason: the tech is being used for secure data sharing, automated smart contracts, and enhancing fraud resistance.

- Predictive analytics: Insurance companies are using technologies like ML (Machine Learning) on historical claims, behavior, and external data (through wearables, IoT devices, etc.). This has given them the power to proactively assess risks, early interventions, perform accurate underwriting, premium adjustments, and fraud prevention.

- Personalized insurance products: AI and data analytics go hand in hand to create hyper-personalized policies, premiums, and recommendations based on individual health data, lifestyle, and real-time risks. This has empowered insurance companies in terms of delivering customer-centric offerings, usage-based models, and preventive care integration for better outcomes and retention.

Final Note

By all means, health insurance today is not a support function. Instead, it is an industry of its own with real competitors that are redefining the domain. But that isn’t the end, but a sign for a new arrival. Rising data volumes, regulatory complexities, and, moreover, customer expectations that are custom, are willing to give a chance to newer players.

So, the real question is, does your idea have the mantle to be that new player? Well, there is no correct answer unless you get an MVP done and roll your idea into the market. And, if that succeeds, turn it into a full-fledged product. And if you need help, we can help you with both in terms of development.

FAQs:

Q.1 How can health insurance software improve operational efficiency for insurance companies?

Health insurance software is capable of automating your workflows and operations. It enables customers to pick and choose a policy of their liking and buy it without any manual intervention. Additionally, with AI technologies being utilized in the business, insurance companies are even able to create custom plans and predict product usage to better reinforce their services.

Q.2 How does health insurance software enhance the customer experience for policyholders?

With a health insurance software, policyholders are capable of performing several functions, all on their own, which are:

- Buying a policy online

- Tracking the performance

- Getting notifications

- 24*7 support through AI chatbots + human PoCs (in terms of requirement)

Q.3 What are the must-have features of modern health insurance software?

The must-have largely depends on the kind of services you are delivering and to what type of customers. However, there are a few that can loosely be clubbed into this category:

- Policy administration system

- Claims management module

- Compliance & security controls

- Customer self-service portals

- Provider network management

- Data analytics & reporting dashboards

- API & interoperability support

- Scalable cloud architecture

Q.4 What are the key steps to develop a health insurance software from scratch?

Here is a key structure to follow to develop a health insurance software from scratch:

- Requirement analysis & stakeholder mapping

- Compliance and risk assessment

- UX/UI design for insurers and members

- Architecture & tech stack selection

- Core development & integrations

- Testing, security & compliance validation

- Deployment and ongoing support

Q.5 How does health insurance software help maintain HIPAA and GDPR compliance?

The core requirements of a health insurance software ideally revolve around features like data encryption, role-based access control, and secure authentication because a lot of sensitive data is involved. Each of these is a regulatory control that by default ends up getting integrated into the system.

Q.6 How long does it take to migrate data from legacy health insurance systems to a new platform?

Data migration can take from 6 weeks to 6 months.

The high variation in time exists because of factors like data volume, system complexity, and compliance requirements.

Q.7 Can health insurance software be customized to support region-specific policy rules and pricing models?

Yes. In fact, the build is first thought of from the perspective of the region, it’ll be serving because of compliance.

To achieve that, most systems are built fully custom, adhering to regional policies, pricing structures, and compliance requirements.

Q.8 How does health insurance software integrate with hospital systems and EHR platforms like Epic or Cerner?

Platforms like Epic or Cerner use standard healthcare interoperability protocols to integrate hospital systems or EHRs. For example, HL7, FHIR, and secure APIs.

Q.9 What ongoing maintenance and support are required after deploying health insurance software?

Some of the ongoing services that are required after deploying a health insurance software are:

- Security updates and patching

- Regulatory updates

- Performance monitoring

- Bug fixes

- System backups and disaster recovery

- API and integration upkeep

- Feature enhancements

Q.10 How scalable is health insurance software when policyholders or claim volumes grow rapidly?

Health insurance software today can be highly scalable. This is especially the case if the end-product uses technologies like cloud-native architecture and microservices to create an auto-scaling infrastructure.