Traditional banking processes are often associated with long waits and excessive paperwork. In contrast, digital banking or online banking process simplifies and streamlines the entire banking process, allowing users to perform banking transactions such as account opening, money transfers, handling investments, etc, directly from their mobile phones without any hassle. Realizing the widespread acceptance of digital/mobile banking opened an avenue for startups and enterprises to explore mobile money transfer app services.

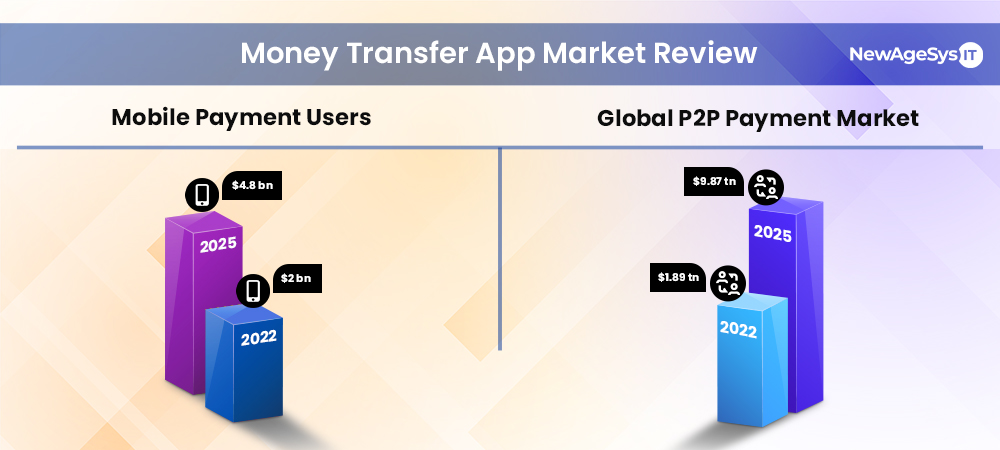

According to a research report published by Spherical Insights and Consulting, the global mobile payment market is expected to reach $9.4 billion by 2025 and an estimated $2,983.9 billion by 2032. Due to the stringent data security and compliance requirements, Fintech startups and large financial institutions like banks, insurance companies, and NBFCs prefer building money transfer apps internally. However, the development of a money transfer app is a complex process and only experts who possess technical and industry knowledge can pull this off.

This guide, created with insights from NewAgeSysIT’s experienced fintech app developers and project managers, who have undertaken numerous FinTech app developments worldwide, provides essential steps and considerations for anyone building a money transfer app. Building payment apps requires more than just visually appealing designs and features; it demands strict adherence to data privacy, security, and regulatory compliance. In this article, we’ll walk you through building a money transfer app in 2024 and explore additional key factors to consider.

How do payment apps work?

Peer-to-peer (P2P) payments can be made quickly and securely via mobile payment apps, also known as mobile transfer apps, eliminating the need for cash or physical cards.

First, users download a payment app, register, and authenticate themselves—often using a fingerprint or PIN. By inputting the recipient’s information and the payment amount, users can then easily transfer and receive money. The stages may differ slightly depending on the app’s capabilities and the payment method, but the procedure is always straightforward.

See how our fintech mobile app development services helped clients build successful Money Transfer Apps.

Types of Money Transfer Apps

While all money transfer apps enable easy P2P payments, they differ in how they are implemented. There are two main types:

Independent Services

With just the recipient’s phone number or email, customers can transfer funds from their bank accounts or debit cards utilizing payment apps, such as Apple Pay, Google Pay, and PayPal. Within the payment app, users can use digital wallets where they can park their money from bank accounts and enable the p2p payment transactions.

Built-in Services

In many apps, payment is a built-in feature among other functions. For example, mobile banking apps enable users to transfer funds between accounts or to other banks, and some messaging apps allow instant transfers while chatting. Users usually link a bank account or card to enable transfers.

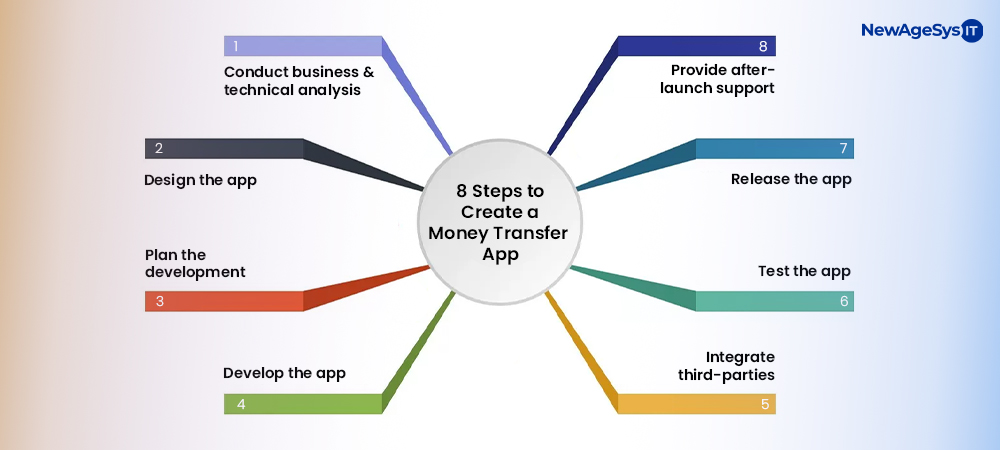

How to Create a Money Transfer App: 8 Essential Steps in the Development Cycle

Step 1: Conduct Business and Technical Analysis

With the growing popularity of P2P payments, competition is intense. To ensure success, start by conducting a demand analysis for your money transfer app. This involves analyzing competitors, surveying potential users, and gathering insights from stakeholders to identify your app’s market fit. For instance, while PayPal and Wise are popular, opportunities exist for niche features, like integrating payment with food delivery or offering investment options.

Once business viability is clear, focus on the technical aspects. Identify the tech stack, security requirements, compliance needs, and infrastructure essentials. For P2P apps, our developers often use Swift and Kotlin for iOS and Android, respectively, while backend solutions are built with Node.js. As one of the top mobile app development agencies, we also select scalable cloud infrastructure, like AWS or Google Cloud, to ensure the app remains reliable and resilient.

Step 2: Design the App

Before development, map out the user journey with mind maps and wireframes, and gather feedback from potential users. Following a structured UI/UX design process, like the one we use at NewAgeSysIT, can help create a design that resonates with users.

An intuitive, well-designed payment app enhances user satisfaction, leading to higher sign-up rates and lower churn. Effective UI/UX design means focusing on elements like screen layout, colors, graphics, navigation, and mobile optimization. For example, in any investment app, clear workflows and simplified views allow users to manage their portfolios effortlessly, leading to high satisfaction with the app’s usability.

Step 3: Plan the Development Process

Developing a payment app necessitates a diverse team of professionals, including:

- Mobile app developers

- Backend developers

- UI/UX experts

- Project manager

- Business analyst

- QA engineer

- Security specialists

The next step is deciding how to work with your team. Some companies opt for an in-house team for greater control and flexibility, though this requires ongoing training, management, and retention efforts. Others prefer to outsource their app development to IT partners like NewAgeSysIT, which enables faster market testing without the complexities of managing the technical process and often provides access to top talent at a lower cost. NewAgeSysIT, being the top mobile app development company, offers flexible models for your app development.

Once you choose a collaboration model, define your app’s requirements, core features, technology stack, project goals, and stakeholder expectations. Next, create a project timeline that outlines key milestones, helping keep the development process aligned with your release goals and marketing plans. For example, ensure adequate time for testing and refining various app features, functionalities, and user experience.

Step 4: Start Developing the App

Now it’s time to bring the app to life. Developers build out the features and functionalities based on the UI/UX design and specifications. Each part of the app is coded to work smoothly with others, focusing on security, user experience, and business logic. Since payment apps handle financial data, security is a top priority.

Different teams handle different parts of the app in parallel. For instance, backend developers build server functions while mobile developers focus on on-screen features for the prototype. Keeping everyone aligned with the project milestones helps avoid delays and confusion.

At NewAgeSysIT, our mobile app development services use Agile methodology for quick testing and iteration. It helps us create functional apps while staying on schedule and addressing issues early.

Step 5: Integrate Third-Party Services

Most payment apps need additional features beyond basic money transfers. Instead of building everything from scratch, integrating third-party services saves time and allows focus on core workflows.

For example, you can integrate:

- Bill payment systems like QuickBooks or Bill.com for automated invoice processing.

- Banks and ATM networks for cash withdrawals or deposits.

- Anti-money laundering (AML) services to detect suspicious transactions.

- Currency exchange gateways for international transfers.

- Third-party integration speeds up development while ensuring robust functionality.

Step 6: Test the App

Testing the app extensively for bugs, security flaws, and technical difficulties before launch is crucial because they might result in monetary losses and data breaches. To cover all features and use cases, employ regression, acceptability, functional, and unit testing.

Step 7: Launch the App

Once testing is complete and issues are resolved, it’s time to prepare for deployment. Set up the database, cloud infrastructure, and backend services needed for smooth operation. Finally, launch the payment app on platforms like the App Store and Play Store.

Step 8: Offer After-Launch Support

Stay ready to address any issues after the app goes live. A support team should be available to quickly handle requests and collect feedback for ongoing improvements. Adding an FAQ section, a GenAI-powered virtual assistant or a co-pilot can also help manage common questions efficiently. As the leading mobile app development company, we offer support from idea validation to post-launch support.

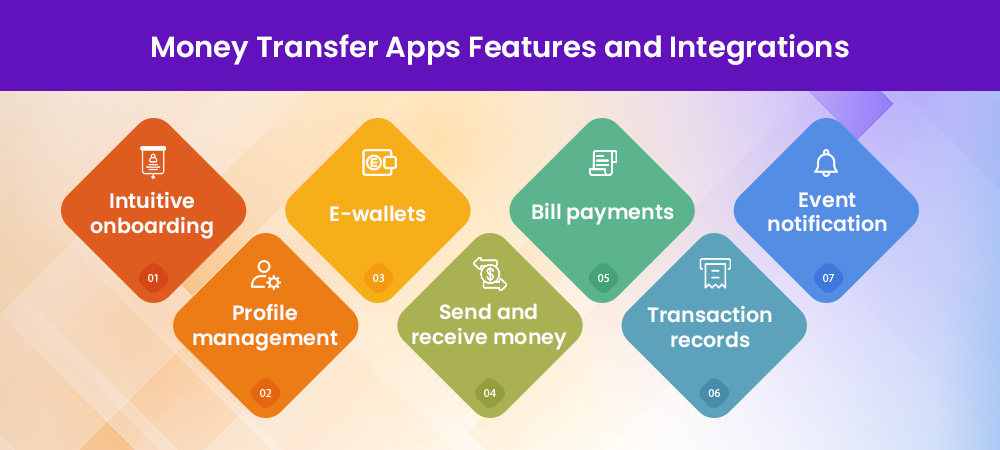

User-Friendly Features and Integrations for Money Transfer Apps

Successful P2P payment apps target different markets but share common traits—they’re user-friendly, engaging, and highly functional. At NewAgeSysIT, we offer custom mobile app development services, integrating your preferred features. Here are some essential features every payment app should include.

Easy Onboarding

Creating an account should be quick and easy. While KYC and AML checks are necessary, providing clear, step-by-step instructions can help users complete their profiles smoothly, reducing the chances of them abandoning the process.

Profile Management

Allow users to easily update their personal information, like addresses, contact details, and payment methods. For example, our investment app lets users add payment methods in just a few simple steps.

E-Wallets

Enable users to load funds from their bank into a digital wallet. With e-wallets, they can make contactless payments at supported merchants.

Send and Receive Money

A core feature of any payment app, users should be able to transfer money to recipients by entering their email or phone number. Some apps even offer bank transfers and bill payments. Make sure this process is easy to access from the main dashboard.

Bill Payments

Adding bill payment capabilities enhances the app’s usefulness. Integrating with service providers that support online payments allows users to pay bills conveniently within the app.

Transaction History

Let users review past transactions with details like dates, fees, recipients, and payment purposes. Our neobank app, for instance, allows users to quickly view their transaction history.

Real-time event notifications

Keep users informed with notifications for essential events—like confirming transfers, security updates, or promotions. This helps users stay updated and builds trust in your app.

Why Choose NewAgeSysIT for Your Money Transfer App Development

- Over 25 years of experience in custom mobile app development services

- Expertise across 30+ industries, including banking and fintech.

- Strong focus on security and regulatory compliance since 2000.

- Quick project start (1–2 weeks) and regular releases (every 2–3 weeks).

- Lean, Agile, and DevOps-driven development culture.

- NewAgeSysIT is a 4-year champion in the list of 100 Fastest Growing Asian American Companies in the USA by the US Pan Asian American Chamber of Commerce (USPAACC)!

Conclusion

Creating a money transfer app has become essential in today’s fintech landscape, where consumers demand fast, secure, and intuitive payment options. At NewAgeSysIT, we bring over 25 years of specialized expertise in developing secure, compliant, and user-focused payment apps. Our deep understanding of the fintech industry and commitment to regulatory standards allow us to deliver robust, high-performing applications that users trust and rely on.

Being one of the top mobile app development agencies, our case studies demonstrate our success in delivering tailored solutions for various fintech clients, and testimonials reflect our commitment to quality and customer satisfaction. If you want to save time searching for the right development partner, drop us a message. We’ve helped several fintech companies worldwide develop secure, functional, and purposeful payment apps.